|

|

Key points:

|

Under the hood of the recent equity rally

Stocks reached new highs at the end of the first quarter, with the S&P/TSX Composite Index up 8.1% for the quarter and the S&P 500 Index up 6.2%, in local currency terms, including dividends. Under the hood of the robust market in the first quarter was one of the most powerful market rotations in years: investors shifted money out of growth-oriented information technology shares and into long beaten-down sectors such as financials and energy. For example, Exxon Mobil Corp. is up 38% and Canadian Natural Resources is up 31% for the year, while Amazon. com Inc. is down 6% and Apple Inc. is down 8%.

Viewing the portfolio through sector and factor lenses

The concept of sector-based portfolio allocation is widely accepted and understood. A portfolio is built up based on the performance of companies in a standard set of economic or industry sectors, such as financials, information technology, utilities, and so on. As the economic cycle turns, investors can adjust the portfolio, tilting it toward cyclical sectors on the way up and defensive sectors when the economy struggles. Factor investing, however, views the portfolio from an angle of how a company performs financially and how its stock performs.

Factors are defined as drivers of stock returns that can be observed and measured over time across different sectors and countries. These common factor “premia” include value, growth, momentum, low volatility, small-cap, and quality — characteristics that have been seen to be associated with outperformance under certain market conditions, or in connection with certain kinds of investors’ behavioral bias. For example, the momentum effect — current winners tend to keep on winning — may be the result of herding behavior, or because investors initially under-react to company news.

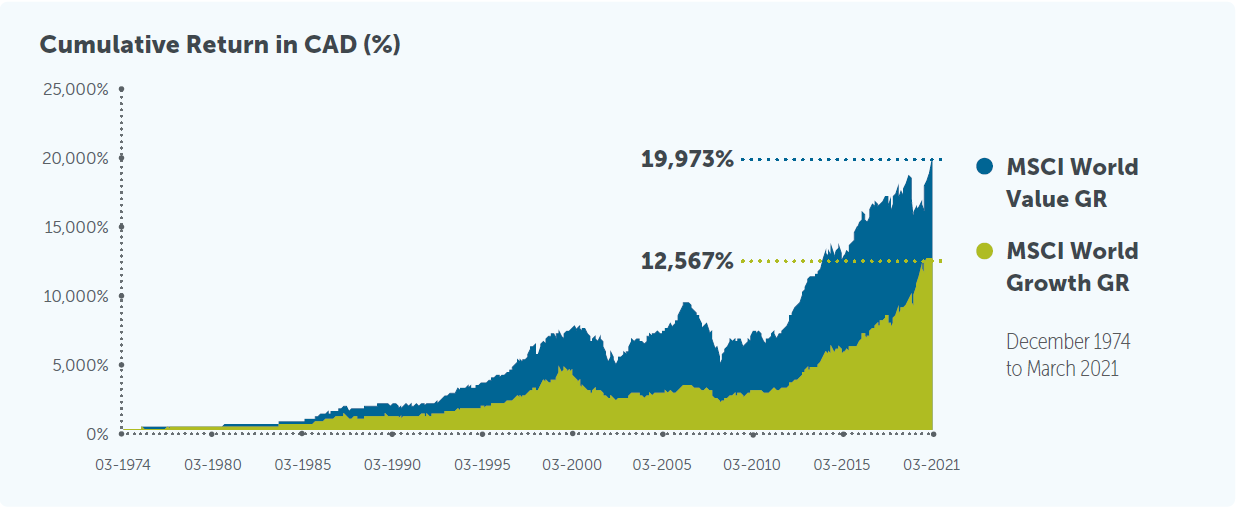

A disciplined framework for picking stocks often reveals a style or factor footprint. At Empire Life, we remain focused on our value-oriented investment philosophy and on high-quality, attractively valued companies. Value is a well-studied factor that has been proven to be a driver of excess returns over long periods of time.

Source: Morningstar Research Inc., as at March 31, 2021

Value underperformance

Just like all the other factors, however, value may exhibit periods of underperformance. The most recent value underperformance, which started at the beginning of 2017, is the worst investors have faced in approximately a century, according to data compiled by Nobel laureates Eugene Fama and his colleague Kenneth French1. Low interest rates are said to be the main culprit behind value’s underperformance: they tend to benefit the stock prices of companies demonstrating strong earnings growth because future earnings are more valuable at a lower discount rate. In a low-growth environment, and particularly during the COVID-led economic downturn, markets favour fast-growing companies and investors are willing to pay a premium to own them.

The powerful rotation to value may continue

Since late 2020, the COVID-19 vaccine rollout has begun to gather pace. The U.S. economy is moving toward reopening and a return to normalcy, against the backdrop of unprecedented fiscal stimulus and very accommodative monetary support. The market has responded forcefully with a powerful rotation to value. In the U.S., value outperformed growth by more than 11% in the second half of the first quarter. With a robust economic recovery likely underway, the stage seems to have set for value to continue to outperform, for the following reasons:

- Historically, simply entering the early stage of a robust economic recovery after a recession has been sufficient to support a rotation to value: value stocks tend to outperform as the operating efficiencies of the associated companies allow them to take advantage of improving economic conditions. In the U.S., value stocks have outperformed by 730 basis points, on average, in the 12 months following a trough in the business cycle.2

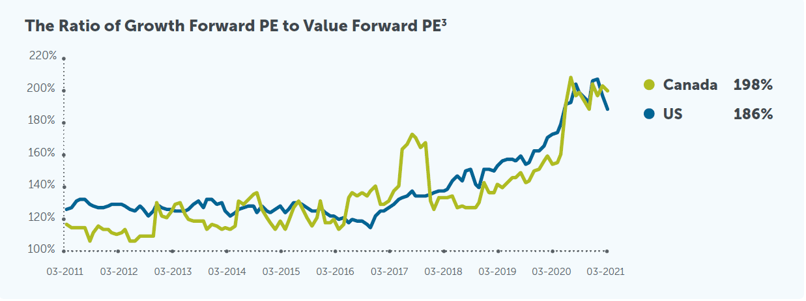

- Currently, growth still trades at a large valuation premium to value — almost twice as expensive, gauged by forward PE, which is well above the historical average and the highest it has been in more than a decade. The domination of growth outperformance over value may have peaked, however. The valuation gap between value and growth points to a resurgence of value outperformance. And the value outperformance we have recently seen may very well have a long way to go before valuations get back in line with historical averages.

Source: Bloomberg, as at March 31, 2021

- Near- to long-term optimal conditions also support value outperformance. The Federal Reserve has signaled its commitment to low rates for the foreseeable future and is willing to let the economy run hot, tolerating an overshoot beyond its stated 2% sustained inflation objective. With a V-shaped recovery well underway, the markets have seen reflation trades, higher interest rates, and a steeper yield curve; all are optimal for value stocks that have a shorter duration profile relative to their cash flows than growth companies. Secularly, the U.S. is in the early stages of a new investment cycle into infrastructure and innovation. The future incremental profit is likely to accrue for many large value companies that have the size and scale to deploy new technology to transform their businesses and benefit from the structural improvements of efficiency.

The long-term success of a disciplined process that overcomes behaviour bias

Nobody has a crystal ball on what exactly the future will hold, and most of us tend to be driven by a powerful human behaviour bias called “recency effect.” This is a cognitive bias that favours the most recent experience; it drives the all-too-common investment practice of chasing winners — a strategy that does not succeed consistently over the long run.

At Empire Life, we believe that a comprehensive investment approach involving diversified investments is a better option than chasing the returns of hot stocks or narrowly focused asset classes.

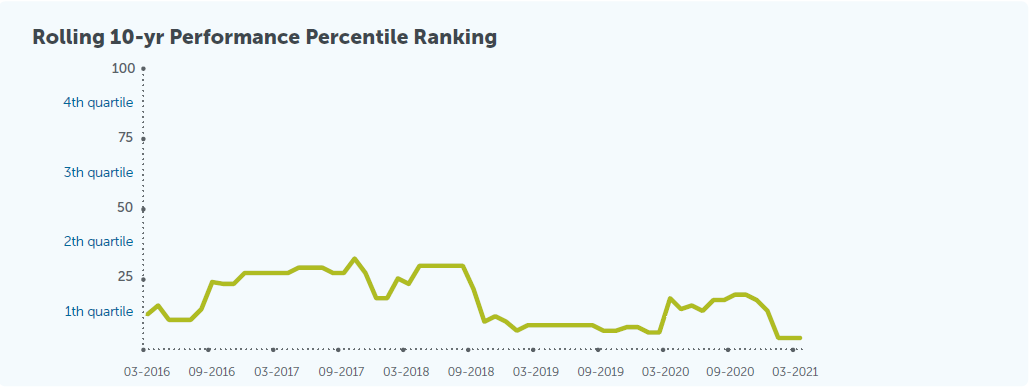

For example, the Empire Life Asset Allocation Fund, one of the largest and most popular Empire Life segregated funds, is a single-ticket investment solution that involves actively managed investments, with a focus on value and quality, offering proper diversification and a reasoned asset allocation strategy — and has outperformed its peer group average across the short- and long-term horizon.

Performance (%)

| 3 months | 6 months | 1 year | 3 years | 5 years | 10 years | |

| Empire Life Asset Allocation, Class A | 6.1 | 16.4 | 31.8 | 4.6 | 4.3 | 5.3 |

| Tactical Balanced Category Average | 2.0 | 7.2 | 20.4 | 3.9 | 4.1 | 3.0 |

| Quartile Ranking | 1 | 1 | 1 | 2 | 1 | 1 |

Source: Morningstar Research Inc., as at March 31, 2021

The Fund has more investment flexibility than most segregated funds in the industry. Its long-term success can be directly attributed to a disciplined investment process, resulting in a consistent long-term track record of outperformance. Its ten-year rolling performance has been ranked almost exclusively in the first quartile over the last number of years, including during the coronavirus sell-off and the subsequent recovery periods.

Source: Morningstar Research Inc. as at March 31, 2021

The investment landscape is constantly shifting. The marketplace has also become more crowded and competitive. The addition of Empire Life Multi-Strategy Portfolios and Empire Life Global Sustainable Equity GIF to our product shelf provides attractive complementary investment options for customers who want to diversify investment styles and strategies within the same GIF contract. Empire Life will continue to develop a broader product offering to satisfy investors’ increasingly complicated need for different investment strategies and approaches.

Sources:

1 http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

2 Russell Investments https://russellinvestments.com/ca/blog/3-reasons-why-value-stocks-may-outperform-soon

3 US is represented by MSCI USA Index, Canada is represented by MSCI Canada Index

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract, and fund facts before investing. Performance histories are not indicative of future performance.

This material reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

May 2021