How secure do you feel about life after work? Even if work will continue to form part of the next phase in your life, how comfortable are you with your plans and savings for all those tomorrows? Will your plans work, even under adverse conditions? Will you have enough money to do the things you want to do, in the way you want to do them, for what could be a lengthy set of retirement phases? Headline after headline and study after study seem to suggest that people just aren't

How secure do you feel about life after work? Even if work will continue to form part of the next phase in your life, how comfortable are you with your plans and savings for all those tomorrows? Will your plans work, even under adverse conditions? Will you have enough money to do the things you want to do, in the way you want to do them, for what could be a lengthy set of retirement phases? Headline after headline and study after study seem to suggest that people just aren't

saving enough.

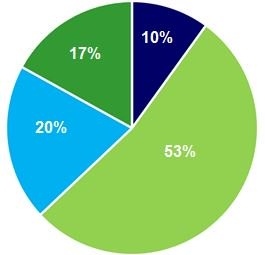

Having a documented plan that is stress tested periodically and working with an accredited, professional advisor can help provide a powerful "one-two punch" to deal with the potential retirement crisis. Consider the following research:

Profile of respondents who feel very secure about retirement

| Work with a financial professional, but do not have a retirement plan | ||

| Work with a financial professional and have a retirement plan | ||

| Only have a retirement plan |

||

| Don't have either a financial professional or retirement plan | ||

|

|

I've frequently written about people's sense of preparedness and security regarding retirement. Those that have a formal long-term savings and a retirement income plan are much more likely to feel very secure about retirement. Working with an advisor can generate similar feelings of security and success.

Most working age people don't have those strong feelings of comfort and security. They may have savings and investments in registered savings plans. They may have fund investments, stocks and exchange traded funds (ETFs). They may not have a holistic plan.

I feel very secure about retirement and I…

|

|

do |

don’t |

|

Have a formal retirement |

65% |

25% |

|

Work with an advisor |

60% |

32% |

|

Source: Deloitte Centre for Financial Services 2015 Retirement Study |

||

Unfortunately, some people who work with an advisor don't have a holistic plan either.

The majority of people that do have plans, don't go through periodic stress testing to see if those plans and the investments forming part of them can continue to do the job they were intended to accomplish. Most tend to go through the process once. Some do it on their own and generally without the requisite expertise. As we all know, things you only do once, you tend to do poorly compared to working with accredited professionals who are focused on this area.

I end many of my articles with a recommendation to speak with an accredited professional who specializes in this

area can help improve your chances of success. It sure can help with peace of mind and feelings of security. It makes money and sense.

| Talk to an investment advisor today to learn more |