Market Implications of the Conflict in the Middle East

Tensions in the Middle East have escalated following the attack on Israel on October 7th by Hamas militants from the neighbouring Gaza Strip. The incursion sparked international backlash, and Israel announced a complete siege of Gaza on October 9th. This conflict has led to a considerable death toll on both sides, a hostage crisis involving over 200 Israeli and international citizens and a growing humanitarian crisis in Gaza.

Key events we are monitoring

As Israel moves onto its so-called second phase of the war, which focuses on a ground offensive in Gaza, fighting has also intensified on Israel’s northern border against Hezbollah, a political party and militant group backed and funded by Iran in Lebanon, and against pro-Iranian fighters in Syria. This escalation has caused growing fears that this will boil over into a full-scale regional conflict.

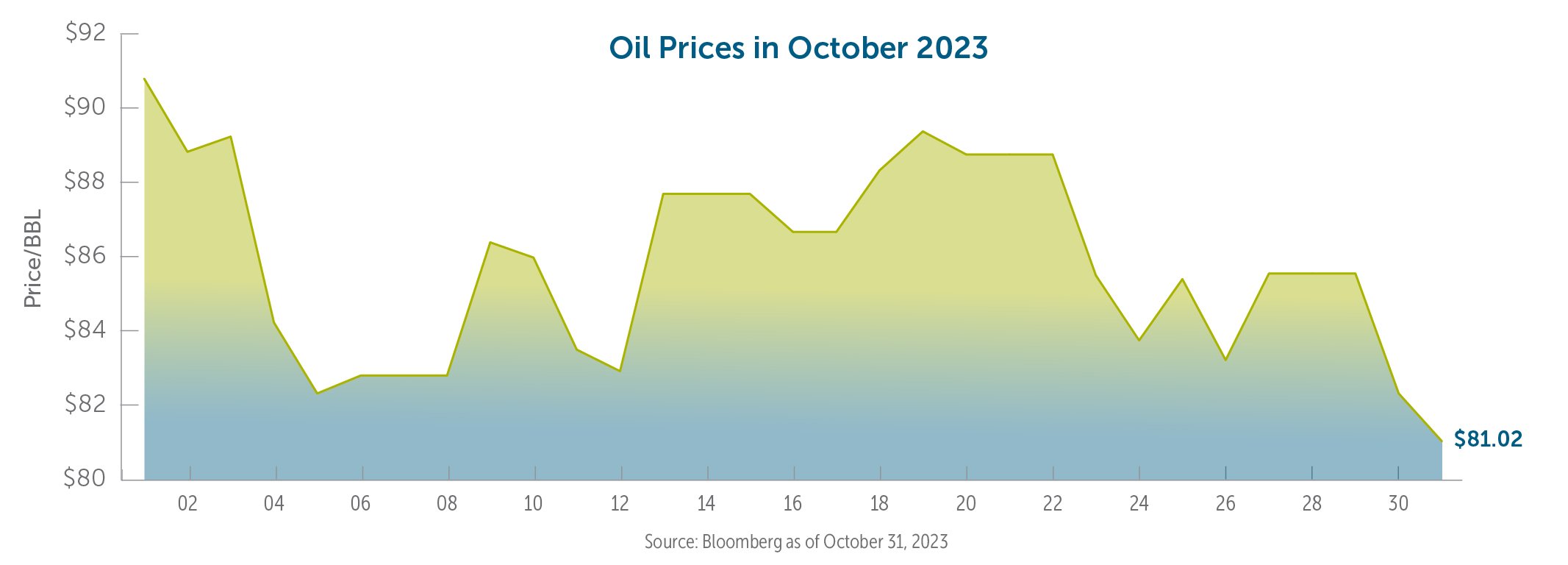

The prospect of a supply disruption in the Middle East, which is the largest oil-supplying region, caused volatility in the oil markets, sending prices as high as $91 a barrel from the $83 a barrel it was trading at prior to the October 7th attack.  As a backer of both Hamas and Hezbollah, Iran’s response to Israel’s ground incursion may have large implications on the price of oil. In particular, Iran is currently producing a near-record amount of oil at 3.5 million barrels a day while the country is technically under US economic sanctions. If the US government decides to take a harder stance on enforcing these sanctions, any significant volume that disappears from the market should send oil prices higher.

As a backer of both Hamas and Hezbollah, Iran’s response to Israel’s ground incursion may have large implications on the price of oil. In particular, Iran is currently producing a near-record amount of oil at 3.5 million barrels a day while the country is technically under US economic sanctions. If the US government decides to take a harder stance on enforcing these sanctions, any significant volume that disappears from the market should send oil prices higher.

Another area where Iran can exert power is the Strait of Hormuz, as part of it lies between Iran and the Omani Musandam Peninsula. Oil tankers carry approximately 17 million barrels of oil, or around 20% of the world’s total consumption, through the Strait each day.1

Any perception of a potential disruption to the Strait or reduction of Iranian oil production would, in our opinion, send oil prices higher.

Outlook and Positioning

Prior to the Middle East crisis, we increased our weighting in energy largely due to attractive fundamentals at levels not seen for decades. Companies in this sector have had strong balance sheets due to higher oil prices, which have enabled them to pay off debt, consistently raise dividends and pay special dividends while buying back shares.

Despite the escalating events in the Middle East, we are maintaining our long positions in energy as we believe that investors have not fully discounted the downside of this complex and volatile situation.

Conclusion

In addition to the war in the Middle East, the war in Ukraine is ongoing with no end in sight. It is surprising that oil prices are lower now than when Russia invaded Ukraine on February 24, 2022, peaking around $1-$2 per barrel higher following the October 7th Hamas attack. We believe that the market has not discounted a sufficient risk premium at current oil prices. Voluntary production cuts by Saudi Arabia have kept the global oil supply tight, and any escalation of the war could send prices higher.

Although we expect significant volatility ahead, we remain confident in our position, which is supported by rigorous research that has identified strong fundamentals. We will continue to monitor the situation and actively trade in this sector to take advantage of opportunities as they arise.

1Source: Strauss Centre for International Security and Law

This document includes forward-looking information that is based on the opinions and views of Empire Life as of the date stated and is subject to change without notice. Information obtained from and based on third party sources are believed to be reliable, but accuracy cannot be guaranteed. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

Empire Life Investments Inc. is the Portfolio Manager of certain of the Empire Life segregated funds. Empire Life Investments Inc. is a wholly owned subsidiary of The Empire Life Insurance Company.

All other trademarks are the property of their respective owners.

Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing. Performance histories are not indicative of future performance.

November 2023