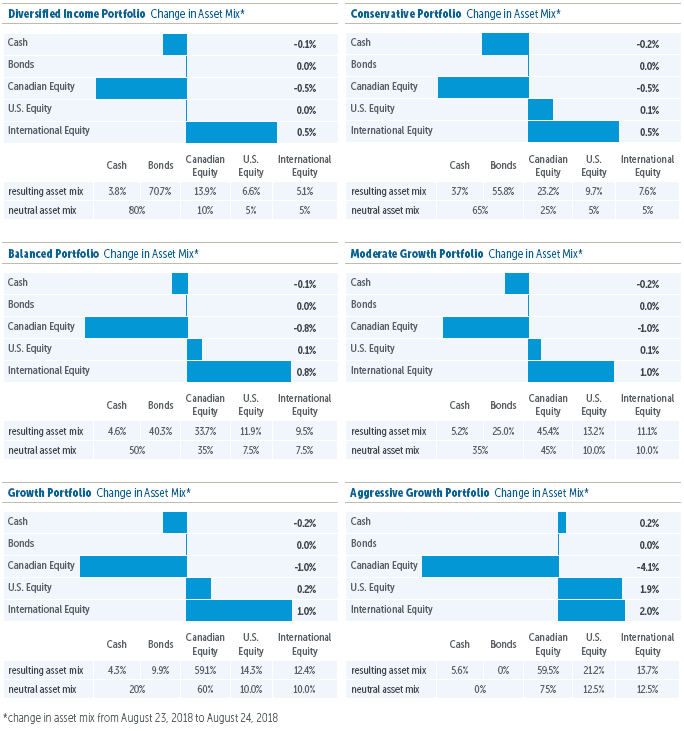

Key takeaways: Tactically increased international equities and decreased Canadian equities. Remain overweight in equities and underweight in fixed income.

After starting the year with strength in the first few weeks of 2018, international equities were caught up in a period of global equity market volatility over the following weeks. Unlike the U.S. and Canadian markets, international markets have yet to fully recover from that volatility.

Over the past four months (to August 24), the MSCI EAFE Index underperformed the S&P/TSX Composite Index by over 5%, before currency effects, and by over 8%, including currency effects.

One factor behind the region’s initial underperformance was the federal election in Italy, where the formation of a populist coalition government ignited market concerns about eurozone stability. These concerns gradually faded, but were replaced by worries regarding increased trade tensions between the U.S. and other international countries.

We believe the risks related to these factors are mostly reflected in current valuations, and as trade tensions stabilize or diminish, international equities may catch up with the performance of North America equities.

We remain positive on Canadian equities, but see a more attractive tactical opportunity over the near term in our defensively oriented portfolio of high-quality international equities.

(data source: Morningstar Direct)

Empire Life Investments Inc. is the Portfolio Manager of the Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Empire Life Emblem GIF Portfolios currently invest primarily in units of Empire Life Mutual Funds.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value.

Policies are issued by The Empire Life Insurance Company.

Empire Life Investments Inc. is the Manager of the Empire Life Emblem Portfolios and Empire Life Mutual Funds (the “Portfolios” or “Funds”). The units of the Portfolios and Funds are available only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such units.

This document includes forward-looking information that is based on the opinions and views of Empire Life Investments Inc. as of the date stated and is subject to change without notice. This information should not be considered a recommendation to buy or sell nor should they be relied upon as investment, tax or legal advice. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.