Key takeaways:

- Tactically moving to a more defensive positioning

- Increased bonds, decreased equities (all portfolios except Emblem Aggressive Growth, which has no bond component)

- Emblem Aggressive Growth – increased US equities, decreased international equities

Tactical update - December 20, 2022

We are choosing to adopt a more cautious posture and see increasingly attractive relative value in fixed income. As such, we have reduced our equity targets in the various Emblem funds and increased our fixed income targets.

The change was made for two reasons that are generally related.

- First, there is real risk of a recession in the coming year. It appears that the US Federal Reserve (the “Fed”) is going to be increasing rates for some period of time but the rate of increase is likely to moderate. The Fed continues to express its intention to keep rates in restrictive territory for some time even as the economy is showing signs of cooling down.

We may be approaching a point where the Fed “breaks something” and the market, particularly the fixed income market, will anticipate that as evidence starts to build. We also enter 2023 with the highest bond yields in more than a decade. This suggests that 2023 will not be nearly as difficult for bonds, especially government bonds, as 2022 has been. - Equity markets meanwhile, are likely going to have to contend with pressure on earnings. As companies are less able to pass along higher prices but experience continued wage pressure (and still some input cost pressures) margins are likely to be under pressure.

In addition, while we’re not overly worried about a deep credit cycle since companies have termed out their debt, the increase in interest rates is going to continue to bleed into higher interest expense for companies as they refinance or borrow in the normal course of business.

Consumers of course are impacted by rising interest costs, high energy costs and declining home values. This is not a great combination.

Empire Life Emblem Portfolios: Asset allocation update

*Change in asset mix from December 15, 2022 to December 20, 2022

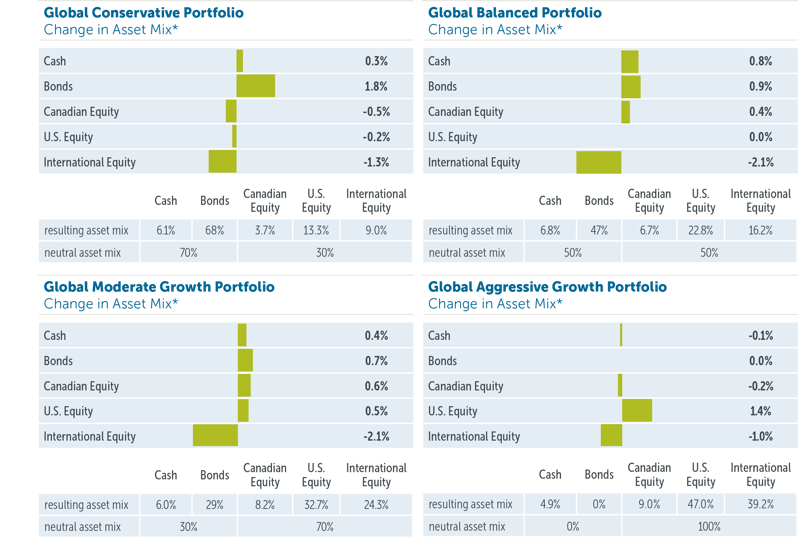

Empire Life Emblem Global Portfolios: Asset allocation update

*Change in asset mix from December 15, 2022 to December 20, 2022

Empire Life Investments Inc. is the Portfolio Manager of the Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Empire Life Emblem GIF Portfolios currently invest primarily in units of Empire Life Mutual Funds.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Policies are issued by The Empire Life Insurance Company.

This document includes forward-looking information that is based on the opinions and views of Empire Life Investments Inc. as of the date stated and is subject to change without notice. This information should not be considered a recommendation to buy or sell nor should they be relied upon as investment, tax or legal advice. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

January 2023