Although it may be more common to see two income Canadian families, many parents are opting to stay at home to raise the kids.The decision to stay at home is usually contemplated when the kids are quite young, and typically, after the second or third child comes along. Then it becomes the financial trade-off decision whether to spend money on daycare or learn how to stretch having only one income in the household.

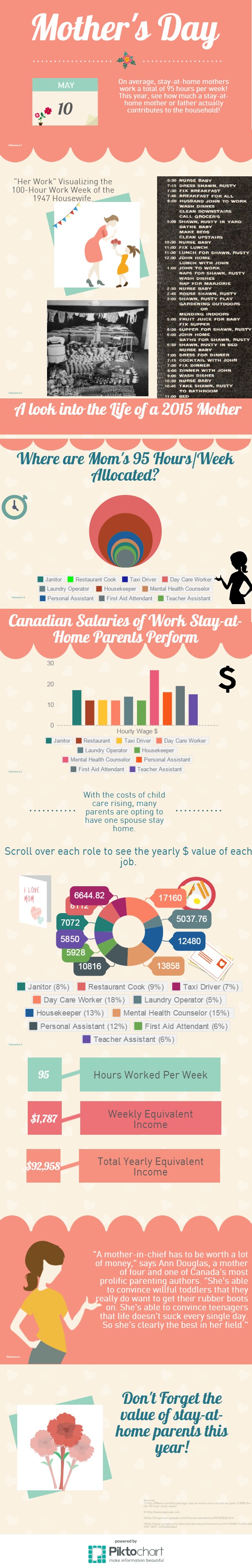

Given that it’s Mother’s Day, let’s take time to stop and consider the value that Mom contributes to the family when she is the stay-at-home parent. We know that even though she is not earning a salary, she is still contributing to the family, but until we really consider the replacement value of not having these important activities taken care of – childcare, transportation, cleaning, cooking, tutoring, etc – Mom’s value is typically underestimated. Check out the infographic below, or the interactive version here.

What about life insurance?

Families with one income often need to look at where they’re spending their money to ensure that all of their obligations are met. The question that some couples are left to answer is – should we insure a stay-at-home parent?

It’s clear from the infographic that a stay-at-home parent has a lot of value and that there are many activities that they do every day that would cost money to replace. If a stay-at-home parent were to suddenly pass away, how could a family continue with their current lifestyle, and for how long? Life insurance can help families handle these new costs.

For many young families where there is a stay-at-home parent, life insurance may be viewed as a “nice to have” but not necessarily a “must have” with no financial priority being given to the purchase. Considering the value of the stay-home-parent, that could be a mistake.

Life insurance can be affordable. Find an advisor to start the discussion and put a life insurance plan in place to help provide security for you and your family, and the peace of mind that comes with it.