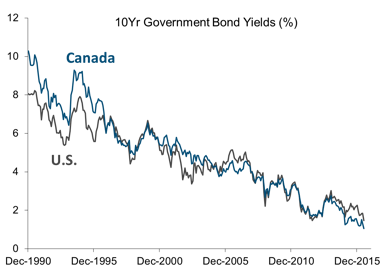

Global bond yields have been on a multi-decade decline; therefore, it should be no surprise that today’s yields are at or close to historically low levels. Chart #1 shows the extent of this decline for the 10 year Government of Canada (“GoC”) and U.S. Treasury (“UST”) bonds. From December 1990 to June 2016, the GoC yield started the period at 10.3%, averaged 5.1%, and closed at a mere 1.06%. Over the same period, the UST yield started at 8.4%, averaged 4.8%, and closed at a mere 1.5%.

If low yields are not surprising, what may be surprising is that significant portions of international government bond markets now provide negative yields. In other words, investors are PAYING governments to hold their hard earned money! At the time of writing negative yields on 5 year government bonds are prevalent in France, Germany, Sweden, the Netherlands, Switzerland, and Japan. When it comes to 2 year government bonds, you can add Italy and Spain to that same country list. It’s as if positive government bond yields are now forbidden (verboten).

Lower yields obviously result in lower income. Another way to look at the impact is determining the investment required to generate a fixed level of annual income. For example, when the 10 year GoC bond provided a yield of 10.3% back in December 1990, it required about a $97,100 investment to generate $10,000 in annual income. Fast forward to June 2016 with a yield of only 1.06%, and it now requires a much larger investment of about $943,000 to generate the same level of income.

There is an investment option, however, where yields have not been in a secular decline; namely equity dividend yields. In fact, Canadian equity yields have been generally rising since the turn of the century. The following chart illustrates the trend in Canadian equity and bond yields. As shown, the S&P/TSX Composite Index’s yield is now meaningfully above that of the 2, 5, 10, and 30 year GoC bonds. This is a dramatic inversion from what was considered normal just ten years ago.

This is not to say that dividend paying stocks carry the same risks as GoC bonds; they are likely to encompass greater risks. For example, a stock’s dividend is much more likely to be cut than the government of Canada defaulting on a bond’s coupon payment. Therefore, it is important to partner with an active value-oriented manager capable of identifying high quality dividend paying stocks that are more likely to maintain or grow their dividends over time.

data sources: Bloomberg (December 1990 – June 2016)