Some of my fellow blog writers have previously commented on the benefits of downside protection through the teams’ value oriented approach to investing. For example, Nessim Mansoor wrote about Rule #1 and Gaelen Morphet wrote about The Asymmetrical Nature of Risk and Return. Today, I’d like to look at it from an asset allocation point of view.

Investors targeting a specific asset mix - say that of a typical balanced fund comprised of 55% equities and 45% bonds - the potential benefit of implementing a value-oriented approach may be lower portfolio risk, compared to an appropriate benchmark. This reflects the conventional view of value investing.

An alternate view comes from the perspective of an investor targeting a certain level of benchmark risk. This investor knows what their risk tolerance is and seeks to maximize growth potential, given that level of risk. A value-oriented approach can be beneficial here as well. With the lower volatility associated with a value-oriented approach, a risk targeting investor may effectively increase their growth potential by increasing their portfolio’s allocation to equities.

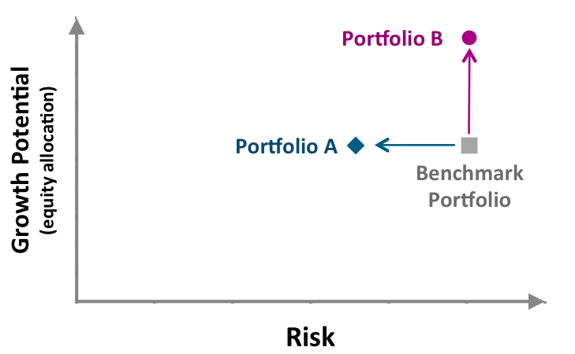

For illustration purposes, the following chart provides a graphical representation of the relationship between risk and growth potential (equity weight) discussed above. Plotted on the chart is a Benchmark Portfolio consisting of a standard Canadian equity index and a standard Canadian bond index. Portfolio A represents the targeted asset mix value-oriented portfolio with potentially lower risk than the benchmark (the conventional view). Portfolio B represents the targeted risk value-oriented portfolio with a higher equity allocation than the benchmark (the alternate view).

In summary, adopting a value-oriented approach to investing may benefit your portfolio whether you are seeking to reduce risk or increase growth potential.