It’s the time of the year when many Canadians have escaped the great white north’s winter misery and travelled to some far-off tropical destination for some needed rest and relaxation. It’s an escape not only from the harsh Canadian winter but also the real world of work and responsibilities. How we wish that state of paradise could last forever. Perhaps that’s why a return to reality is so difficult to deal with.

It’s the time of the year when many Canadians have escaped the great white north’s winter misery and travelled to some far-off tropical destination for some needed rest and relaxation. It’s an escape not only from the harsh Canadian winter but also the real world of work and responsibilities. How we wish that state of paradise could last forever. Perhaps that’s why a return to reality is so difficult to deal with.

That’s what February’s equity markets have reminded me of: returning from a long vacation. Not from a tropical paradise, but from a stock market paradise. The year 2017 was the first so-called “perfect” year for the S&P 500 Index, which delivered positive total returns (including dividends) each and every month. The Index also closed at record highs 62 times, making the feat seem as easy as ordering another cold drink from the pool bar. Not only did stock prices soar, but volatility and fear seemed to have melted away. The S&P 500 Index didn’t have a single day in 2017 on which it moved down by more than 2%. There were only four days when the Index moved lower by more than 1%.

The vacation from volatility came to an abrupt end in early February. On Friday, February 2, stronger U.S. wage growth data deepened concerns of higher interest rates. The S&P 500 Index declined 2.1% – its largest daily loss since September 2016 – followed by a steeper sell-off of 4.1% the next trading day and another 3.8% decline later in the week. Markets attempted to bounce back over the remainder of February, but ended the month with two more days of losses more than 1%. For the month, the S&P 500 lost 3.7% including dividends.

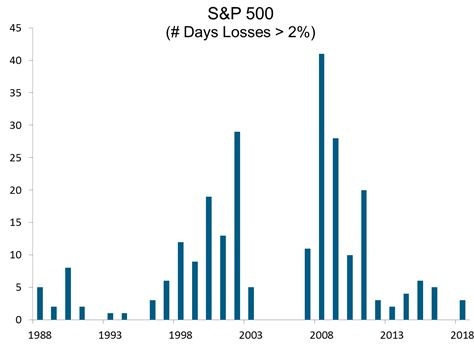

Does February represent the new normal? The answer is likely no. Like returning from an extended vacation, the initial adjustment back to normal life is more difficult than the average normal day. There will ultimately be certain periods that are much more challenging than the average, but it is all part of a normal environment. Extrapolating February’s characteristics and projecting it into the rest of the year result in 33 days of losses of at least 2% in 2018. In the past thirty years – a period encompassing the financial crisis, the dot-com bust and Black Monday – the S&P 500 reached that level of volatility only once (in 2008), and the average annual number of daily declines more than 2% is only eight.

For investors who increased exposure to risky assets based on last year’s trends, perhaps last month can serve as a test as to whether or not the move was appropriate. From an investment manager’s perspective, volatility can be used as an opportunity to buy shares in high-quality companies at more attractive valuations. So put away the flip-flops and sun hat, start eating more carefully, and get back into your exercise routine. Welcome home.

*All data sourced from Bloomberg.

This document reflects the views of Empire Life as of the date published and is for general information purposes only. It is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

This document includes information which we believe to be reliable and is subject to change without notice. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.