Asset Allocation

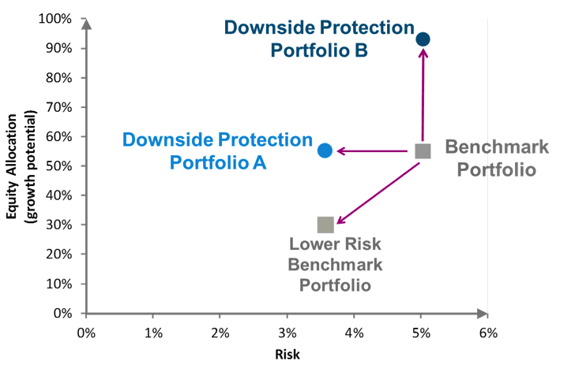

The conventional method to reduce risk in a balanced portfolio involves decreasing the portfolio’s riskier asset class, which for most investors is likely the equity allocation. For example, shifting from 55% equities and 45% bonds to 30% equities and 70% bonds. The following graphic illustrates this as the move to the “lower risk benchmark portfolio”. While this will likely result in lower risk over the longer term, the sacrifice in potential growth may be unappealing to investors that require higher growth potential to reach their goals.

Instead of reducing allocation to the higher risk - and higher growth - asset class, an alternate method is to reduce the risk within that asset class by implementing downside protection strategies. An earlier blog discussed potential ways of achieving this, namely diversification, value-oriented investing, and dollar cost averaging. By using these strategies, it may be possible to reduce the portfolio’s risk without having to sacrifice its equity allocation and therefore its growth potential. This is illustrated as move to “Downside Protection Portfolio A” in the graphic.

Downside protection, however, is not limited in its use to risk-averse investors. Investors seeking to maximize growth potential, given a certain level of risk, may also benefit. The reduced risk within equities may allow the investor to meaningfully increase their equity allocation and still maintain the same risk as the benchmark portfolio. This is illustrated as a move to “Downside Protection Portfolio B” in the graphic.

For Illustrative Purposes Only

Sequence of Returns

Sequence of returns refers to the order in which returns unfold. Strong performance may be encountered early in a cycle, followed by weak returns, or vice-versa. When drawing income from a portfolio, the sequence of returns can have a dramatic effect on total income, despite potentially having no effect on the portfolio’s performance.

Consider the following two hypothetical sequences of annual returns. The only difference between the two is that one sequence unfolds in the inverse order of the other, with Sequence A having strong returns in the early years, and Sequence B having weak returns in the early years. Not surprisingly, both sequences result in the same ten year annualized returns of 4.4%.

Annual Returns

| Year: | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Sequence A | 24% | -10% | 12% | 16% | 12% | -8% | 14% | 18% | -4% | -20% |

| Sequence B | -20% | -4% | 18% | 14% | -8% | 12% | 16% | 12% | -10% | 24% |

When drawing income from a portfolio, however, the sequence of returns dramatically affects total income generated. The following table illustrates the annual income generated from a $500,000 initial portfolio, drawing 8% income per year (based on the previous year end value). This is similar to a T8 series mutual fund, except income is drawn annually instead of monthly to simplify the example.

Annual Income (thousands)

| Year: | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Sequence A | $40 | $46.4 | $38 | $39.6 | $42.7 | $44.4 | $37.3 | $39.6 | $43.5 | $38.3 |

| Sequence B | $40 | $28.8 | $28.8 | $25.3 | $27.9 | $24.8 | $25.8 | $27.9 | $29 | $23.8 |

Cumulative income under Sequence A is $409,944. Cumulative income under Sequence B is $282,867 - a 31% decrease in total income because of the unfavourable sequence of returns. Recall that total performance is the same, but total income is vastly different.

What can be done? Downside protection strategies may not be able to completely neutralize the negative impact, but they can provide a meaningful cushion. If we consider downside protection to mean having an upside capture ratio of 90% and a downside capture ratio of 60% (capture ratios were discussed in my previous blog), and apply those capture ratios to Sequence B, total income rises to $311,661. That’s a 10.2% increase in total income compared to Sequence B.

I would like to end this four part blog series on downside protection with a quote from Sir Richard Branson, founder of Virgin Group:

“Over the years, my colleagues and I have developed quite a reputation for risk-taking. It's true that we have been fearless about taking on new businesses, sectors and challenges even when the so-called experts told us that we did not know what we were doing. But while, to all appearances, we do have an unusually high tolerance for risk, our actions always spring from another principle: Always protect the downside. I think it should be a guideline for every entrepreneur -- or anyone involved in business ventures.”

- Entrepreneur.com (October 31, 2010)