As we head into the new year, tariff and trade uncertainty remain a key issue. There has been some real progress through 2025, but an agreement has remained elusive between the U.S. and some of its key trading partners (such as Canada and Mexico), and we have seen flareups and cool-downs in trade tensions with China.

Outlook

| HIGHLIGHTS |

|

Will the full impact of tariffs be felt by Americans?

To date, the impact of the tariffs has been relatively muted. In the three months ending in August, consumer spending has increased, with the rise boosted by both nondurable goods and services.1 There has been some upward pressure from tariffs on prices as measured by the CPI,2 but not yet to the extent that was feared. This remains something to pay attention to in 2026.

Will tariffs tilt the balance of power in upcoming elections?

The U.S. midterm general elections are scheduled to take place on November 3rd. All 435 seats in the U.S. House of Representatives and 35 seats in the Senate will be contested. Although the U.S. economy is still showing signs of strength due to strong consumer demand, the full potential impact of the tariffs has yet to be felt. Whether or not this plays a role in the midterms is yet to be seen. However, with narrow Republican majorities in the House and Senate, any economic pain felt by voters could be a decisive issue at the ballot box.

Despite the uncertainties caused by trade and tariffs, we remain optimistic about the U.S. economy. We are seeing a re-onshoring of manufacturing jobs and private investments being made in the U.S. As well, strong fiscal stimulus and more rate cuts (if they materialize) could be supportive of U.S. economic growth. Going into an election year, there’s good reason to anticipate supportive policies to boost domestic growth.

A new investment frontier

A new investment frontier

The U.S. is also likely to be a continuing beneficiary of the emerging space economy. The majority of launches are from the U.S., or by U.S. companies,3 and they are driving costs down. This enables commercial opportunities that were previously not feasible economically.

A leader in the “energy renaissance”

This year, there have been four executive orders announced to  expand nuclear energy production and a historic $80-billion-dollar investment with private firms announced in October to deploy a fleet of nuclear reactors across the country.

expand nuclear energy production and a historic $80-billion-dollar investment with private firms announced in October to deploy a fleet of nuclear reactors across the country.

The U.S. also possesses a bounty of natural resources. We will continue to monitor whether strong oil production across multiple basins continues, despite current depressed prices. Another important factor we will monitor is natural gas export volumes as Europe tries to wean itself off Russian energy imports.

The expanding horizon of AI-Driven growth

The expanding horizon of AI-Driven growth

Hyperscaler capital spending is forecasted to increase substantially in 20264. These companies provide large-scale cloud computing services through massive data centres. This drives the entire ecosystem from the semiconductors to the industrial companies building the data centres.

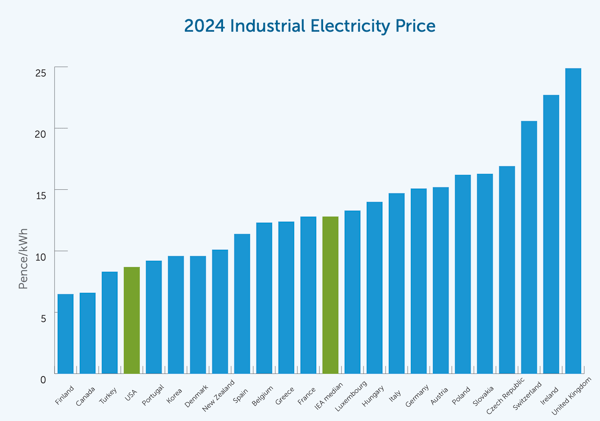

One of the other happy side effects of the U.S. energy renaissance is that the abundance of natural gas has helped contain industrial electricity prices. As shown in the chart below, industrial electricity costs are among the lowest in the U.S. However, this doesn’t change the fact that they are going to need a lot more power generation to support the AI rollout.

Source: United Kingdom Department for Energy Security & Net Zero, December 31, 2024

![]() Download the full Empire Life 2026 Market Outlook (PDF).

Download the full Empire Life 2026 Market Outlook (PDF).

1 Bureau of Labor Statistics, bea.gov/news/2025/personal-income-and-outlays-august-2025

2 Bureau of Labor Statistics, Consumer Price Index, September 2025

3 “Space Economy”, OECD, oecd.org/en/topics/policy-issues/space-economy.html

4 “The Cost of AI: How Hyperscaler Spending is Impacting Semiconductor Supply”, fusionww.com/insights/resources/the-cost-of-ai-how-hyperscaler-spending-is-impacting-semiconductor-supply, September 15, 2025

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Please seek professional advice before making any decisions.

Empire Life Investments Inc. is the Portfolio Manager of certain Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Segregated fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

® Registered Trademark of The Empire Life Insurance Company. All other trademarks are the property of their respective owners.

December 2025