.jpg?width=804&height=536&name=GettyImages-636069862%20(1).jpg)

Although tariff uncertainty still exists, we recognize some pockets of growth and resilience in global equities. We will continue to monitor tariffs and geopolitical developments, however, there are some emerging global themes that leave us feeling encouraged.

Outlook

| MID-YEAR HIGHLIGHTS |

|

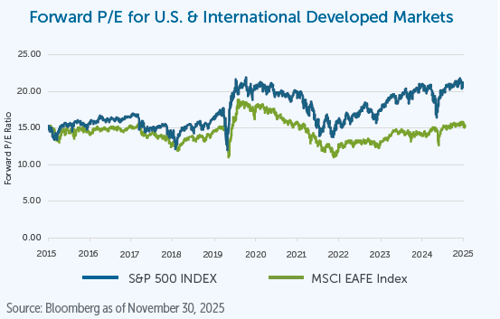

Developed markets (excluding the U.S. and Canada) have been trading at a discount to U.S. equities, as shown in the chart below. We expect this to continue in the new year, and see opportunities presented by this trend.

Targeting high-quality “Global Champions” in Europe

Europe is still suffering from muted growth and ongoing global and geopolitical issues. We don’t expect to see a material change in 2026 and we believe this is reflected in valuations.

Europe is still suffering from muted growth and ongoing global and geopolitical issues. We don’t expect to see a material change in 2026 and we believe this is reflected in valuations.

European rates historically hovered around zero, which resulted in the banking sector having very low returns on equity. This is no longer the case, and banks, which are a substantial part of the market, are considerably more profitable. Although we have some exposure to domestically focused businesses (i.e. banks) we are more heavily exposed to companies that we call “Global Champions”. These are largely global blue-chip companies with defendable competitive advantages, excellent management teams with healthy cash flows and strong balance sheets, many of which happen to be domiciled in Europe. Examples of these businesses include SAP (technology), LVMH (luxury goods), ASML (semiconductor capital equipment) and Inditex (Zara/apparel retail).

Optimism around new growth-focused leadership in Japan

Japan faces many of the same issues pressuring Europe—low growth, tariffs and geopolitical tensions. None of this is new, and for this reason our investment approach is broadly similar, where we have included some strong domestic businesses and many Global Champions. However, there are aspects of the country’s domestic politics and inflation that are unique to Japan. The Liberal Democratic Party (LDP) has been in power for nearly all of the past 50 years. The newly elected female Prime Minister, Sanae Takaichi, is seen to share many similarities with the late Shinzo Abe1, the highly growth-focused former Prime Minister of Japan. She has released a manifesto which includes the promotion of tax cuts, nuclear restarts, an upward adjustment to the retirement age, and an increase in national defence spending. Having been elected in October, her impact is yet to be seen, but we are quite encouraged. We believe tax cuts are critical due to Japan’s recent reversal of chronic deflation, which lasted nearly three decades.2 This has caused high relative inflation that has impacted consumer spending, causing a shift towards discount products, benefitting the discount retail chains in the country. One of our long-term holdings, Pan Pacific, runs the highly regarded Don Quijote discount chain in Japan and has been a key beneficiary of this trend.

are aspects of the country’s domestic politics and inflation that are unique to Japan. The Liberal Democratic Party (LDP) has been in power for nearly all of the past 50 years. The newly elected female Prime Minister, Sanae Takaichi, is seen to share many similarities with the late Shinzo Abe1, the highly growth-focused former Prime Minister of Japan. She has released a manifesto which includes the promotion of tax cuts, nuclear restarts, an upward adjustment to the retirement age, and an increase in national defence spending. Having been elected in October, her impact is yet to be seen, but we are quite encouraged. We believe tax cuts are critical due to Japan’s recent reversal of chronic deflation, which lasted nearly three decades.2 This has caused high relative inflation that has impacted consumer spending, causing a shift towards discount products, benefitting the discount retail chains in the country. One of our long-term holdings, Pan Pacific, runs the highly regarded Don Quijote discount chain in Japan and has been a key beneficiary of this trend.

Identifying compelling opportunities in China

The Chinese economy continues to be impacted by declining residential property prices. This is negatively impacting consumer spending, the construction industry and demand for raw materials. The economy is also suffering from tense trade relations with the U.S. Against this backdrop, there are still encouraging signs. Leading luxury goods companies have noted a recent rebound in sales. Similarly, Macau, a region on the country’s southern coast known for its large casino industry, has experienced a pickup in gaming expenditures.

The Chinese economy continues to be impacted by declining residential property prices. This is negatively impacting consumer spending, the construction industry and demand for raw materials. The economy is also suffering from tense trade relations with the U.S. Against this backdrop, there are still encouraging signs. Leading luxury goods companies have noted a recent rebound in sales. Similarly, Macau, a region on the country’s southern coast known for its large casino industry, has experienced a pickup in gaming expenditures.

We remain encouraged by the demand for EVs in the country and maintain a generally optimistic view of the technological innovation taking place in China. Chinese EVs have leading-edge capabilities and have been able to grasp a large chunk of the global, non‑North American market share. This not only supports the domestic automotive industry but has also contributed to the strong demand for semiconductor capital equipment.

Finally, while Generative AI started as a U.S. phenomenon, this is no longer the case. Chinese tech powerhouses have developed their own large language models (LLMs) and cloud solutions that are being used globally.

We remain cautious on overall GDP growth in China but are optimistic about certain pockets of the economy that are demonstrating resilience and growth.

![]() Download the full Empire Life 2026 Market Outlook (PDF).

Download the full Empire Life 2026 Market Outlook (PDF).

1Sanae Takaichi sees herself as the successor to Shinzo Abe. But changes in Japan’s politics present big challenges”, https://www.

chathamhouse.org/2025/10/sanae-takaichi-sees-herself-successor-shinzo-abe-changes-japans-politics-present-big, October 22, 2025

2"Japan’s Three Lost Decades-Escaping Deflation”, https://www.nomuraconnects.com/focused-thinking-posts/japans-three-lost-decadesescaping-deflation/, July 2023"

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Please seek professional advice before making any decisions.

Empire Life Investments Inc. is the Portfolio Manager of certain Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Segregated fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

® Registered Trademark of The Empire Life Insurance Company. All other trademarks are the property of their respective owners.

January 2026