Annual update discusses potential headwinds for the Canadian and U.S. economies in 2026 as well as projections for corporate bond spreads in the new year, and how AI spending will continue to impact the debt markets.

Overview

| MID-YEAR HIGHLIGHTS |

|

The Canadian economy showed some resilience in 2025, increasing 0.6% in the third quarter of the year. As a result of trade tensions, rising uncertainty, and weaker growth, the Bank of Canada cut rates four times this year, with its most recent cut in October.

U.S. real GDP increased at an annual rate of 3.8% in the second quarter of 2025. We were also beginning to see signs of a cooling labour market and consumer sentiment.1

Corporate credit spreads remained historically tight for most of 2025 reaching levels last seen in 2007.2 This reflected strong demand for income and strong credit fundamentals with low default rates for high‑yield.

Outlook

Government Bonds

Uncertainty ahead for the Canadian economy

There are a number of potential headwinds facing the Canadian economy in the new year. Though headline inflation has been moving closer to the Bank’s 2% target, core inflation has remained stubbornly around 3%. However, in the Bank’s view, some of the upward pressures on inflation have begun to ease, so core inflation may continue to decline into 2026. The impact of tariffs has been somewhat muted as many goods remain exempt under the existing CUSMA agreement, but this will likely change if a new agreement is negotiated.

There are a number of potential headwinds facing the Canadian economy in the new year. Though headline inflation has been moving closer to the Bank’s 2% target, core inflation has remained stubbornly around 3%. However, in the Bank’s view, some of the upward pressures on inflation have begun to ease, so core inflation may continue to decline into 2026. The impact of tariffs has been somewhat muted as many goods remain exempt under the existing CUSMA agreement, but this will likely change if a new agreement is negotiated.

The labour market in Canada has been mixed with recent job numbers showing some gains that largely reversed some of the losses from the summer, but the composition has not been as strong. Additionally, given the elevated uncertainty, businesses have indicated that they are slower to hire, and less likely to expand. We could see further pressure on consumers as mortgages renew in 2026 off of COVID-era rates.

Because of these factors, we believe that the Bank of Canada will continue to remain data dependent and consider further action as incoming data evolves. Although there were a number of pro-growth measures announced in November’s federal budget, many of them are longer-term in nature and are unlikely to spur short-term growth, which may force the central bank to step in if growth suffers.

U.S. economy confronts CUSMA review and IEEPA

South of the border, the U.S. economy will also be impacted by the CUSMA review, along with the outcome of the Supreme Court ruling regarding the International Emergency Powers Act (IEEPA) tariffs.

The labour market in the U.S. began to weaken towards the end of 2025 with job growth slowing3 and, job cuts4, layoffs and duration of unemployment all rising5. However, the labour market still shows signs of one that is gradually easing and gaining slack as opposed to one that sees unemployment spiking.

2025 with job growth slowing3 and, job cuts4, layoffs and duration of unemployment all rising5. However, the labour market still shows signs of one that is gradually easing and gaining slack as opposed to one that sees unemployment spiking.

We are likely to see fiscal stimulus from the One Big Beautiful Bill Act, and potential for tariff refunds depending on the ultimate ruling by the Supreme Court regarding the IEEPA tariffs, which should be helpful for consumers.

However, the U.S. remains in a K-shaped economy where the lower half of the income spectrum remains under pressure, as compared to the upper half.

Finally, uncertainty remains regarding the direction of future monetary policy due to leadership changes at the Federal Reserve. Jerome Powell’s term as Chair concludes in May. Should we see a successor who is open to further easing, we could see it play out at a faster pace, while running the risk that inflation fears are stoked again.

Corporate bonds

A focus on high-quality bonds

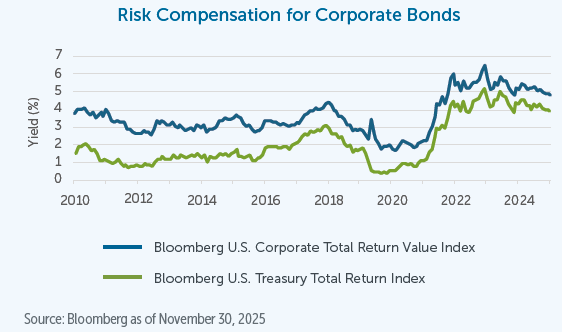

We enter 2026 with tight spreads and thus less room for spread compression. In the absence of any shocks, returns are driven more by carry income in this environment. Despite these tight spreads, all-in yields are attractive relative to recent history. As shown in the graph bellow, corporate bond yields were at a 15-year high, with only 0.85% coming from risk compensation.

This environment can persist for an extended period of time making it important to remain invested in bonds to capture that income. However, given the tighter spreads we will maintain a conservative position in investment-grade and higher-quality high-yield bonds, as we don’t believe investors are being sufficiently compensated for lower-quality issuers.

Debt tied to AI expected to see continuous growth

Debt-funded merger and acquisition activity and the massive AI-driven capex super-cycle have resulted in significant debt issuance, and these trends are likely to continue. Executives at firms like Goldman Sachs were predicting global deal flows could surge to $3.9 trillion in 2026, potentially surpassing the all-time record set in 2021, which would increase debt issuance. Meanwhile, the amount of debt tied to AI has grown to US$1.2 trillion, making it the largest segment in the investment grade market6 and we expect this to continue as private companies pour money into expanding data centres and power infrastructure to support their growth.

Weaker issuers to come under pressure

We expect the default environment to remain at low levels, however we do expect the rate to rise in the new year. In 2025, defaults were concentrated in the U.S., and primarily in distressed exchanges.7 These are companies that offer creditors new securities, cash, or a combination of both for their existing debt. This was followed by missed payments and bankruptcies.

We expect ongoing tariff tensions and credit tightening to pressure weaker issuers in the new year.

![]() Download the full Empire Life 2026 Market Outlook (PDF).

Download the full Empire Life 2026 Market Outlook (PDF).

1October Challenger Report, challengergray.com/blog/october-challenger-report-153074-jobcuts-on-cost-cutting-ai/, November 6, 2025

2Bloomberg, October 31, 2025

3 US Employee Non-Farm Payrolls, Bureau of Labor Statistics, August 31, 2025

4Challenger, Gray & Christmas, October 31, 2025

5Conference Board, Bureau of Labor Statistics, August 31, 2025

6AI Becomes Largest Segment of Investment Grade Debt”, structuredfinance.org/ai-becomes-largest-segment-of-investment-grade-debt/, October 10,2025

7 Default, Transition and Recovery: Bankruptcies Drive Default Tally for the First Time in 2025”, S&P Global, October 16, 2025

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Please seek professional advice before making any decisions.

Empire Life Investments Inc. is the Portfolio Manager of certain Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Segregated fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

® Registered Trademark of The Empire Life Insurance Company. All other trademarks are the property of their respective owners.

January 2026