.jpg?width=804&height=536&name=GettyImages-1134908837%20(1).jpg)

As we begin the new year, we have a slightly negative outlook on Europe, slight optimism on China and a continued positive view of Japan.

2023 overview

Overall, the strong performance of global equities in 2023 was not driven by a particular investment style.

The performance of European equities was driven by higher interest rates, which led to the material outperformance of banks and other rate-sensitive sectors. However, as Europe’s third largest trading partner,1 a slowing Chinese economy had a negative impact on exports.

China’s tepid post-COVID recovery and macro pressures, such as a contraction in Chinese manufacturing, surging youth unemployment, deflationary pressures and a slumping property market, have all contributed to China’s economic malaise in 2023.

Japanese equity performance was strong throughout 2023. This was underpinned by rising inflation and a depreciation in the yen, which has declined by 20% on average against major currencies since early 2022,2 making imports relatively more competitive and inbound travel more attractive. Finally, a shifting corporate culture that permits shareholder activism is also believed to have played a role in the strong performance. Unlike other economies, such as the U.S. and Europe where investor activists tend to focus on environmental, social & governance (ESG) issues, shareholder activism in Japan is driven by business performance and governance.3

2024 Global equities outlook

As we begin the new year, we have a slightly negative outlook on Europe, slight optimism on China and a continued positive view of Japan.

Europe

GDP projections for Europe continue to be revised downward, to just over 1% for the year.4 This can be attributed to the high cost of living, monetary tightening and a contracting manufacturing sector, which is impacted by the slowdown in China, its third-largest export market.

Additionally, a trend appears to be emerging, whereby Chinese tourists have become keener on traveling within their own borders rather than internationally. If this trend reverses in 2024, it is expected to be a positive catalyst for Europe.

Like much of the developed world, Europe has also been impacted by higher interest rates which has weighed heavily on borrowing and capital expenditures, particularly in more capital-intensive industries, such as construction, manufacturing and machinery, as well as those that supply them (metal mining, lumber, fabricated metals).5

Higher rates are also impacting consumer discretionary spending and will likely continue to do so throughout the year.

China

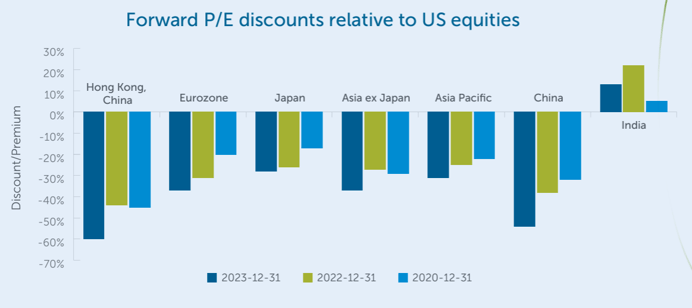

Although we maintain a cautious outlook on China due to the ongoing geopolitical concerns and property crisis, we see some opportunity in Chinese equities, which exhibit attractive valuations, even when factoring in a country discount. We continue to see opportunities in the discrepancy between the fundamentals of many Chinese companies and their valuations, whereby strong fundamentals are not captured.

Source: Bloomberg as at Dec, 31, 2023. The following indices are displayed in the graph above. Hang Seng Index (Hong Kong), Euro Stoxx 50 PR (Eurozone), Tokyo Stock Price Index (Japan), MSCI AC Asia ex Japan (Asia Pacific), MSCI China Index (China), MSCI India Index (India).

Source: Bloomberg as at Dec, 31, 2023. The following indices are displayed in the graph above. Hang Seng Index (Hong Kong), Euro Stoxx 50 PR (Eurozone), Tokyo Stock Price Index (Japan), MSCI AC Asia ex Japan (Asia Pacific), MSCI China Index (China), MSCI India Index (India).

Japan

We believe that Japanese equities will continue to outperform in the new year, however, there are some headwinds expected. In particular, Japan is experiencing its highest rate of inflation in almost a decade at 3.21%6 in 2023. In addition, most economists believe that the Bank of Japan will adjust its negative interest rate policy in 2024.7

Despite the existence of these headwinds, we expect that they will be more than offset by several tailwinds. This includes changes in Japan’s Corporate Governance Code that strongly encourages companies to increase their Return on Equity (ROE) and shareholder returns. We expect that this will result in lower levels of cross shareholding, a practice that is common in Japan where publicly traded companies own shares in other public companies, which may not be in the best interest of shareholders. Seeing an opportunity, activist funds are stepping in and buying these shares, building large ownership stakes in companies and encouraging management teams to be more shareholder friendly.

![]() Download the full Empire Life 2024 Market Outlook (PDF).

Download the full Empire Life 2024 Market Outlook (PDF).

1 European Union, https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/china_en

2 East Asia Forum, October 31, 2023 https://eastasiaforum.org/2023/10/31/an-undervalued-yen-poses-problems-for-the-bank-of-japan/

3 Pham, Nga, “Shareholder Activism in Japan”, June 23, 2020 https://blogs.cfainstitute.org/ investor/2020/06/23/shareholder-activism-in-japan/

4 European Commission, November 15, 2023 https://economy-finance.ec.europa.eu/economic-forecast-and-surveys/economic-forecasts/autumn-2023-economic-forecast-modest-recovery-ahead-after-challenging-year_en

5 S&P Global Market Intelligence, June 30, 2023 https://www.spglobal.com/marketintelligence/en/mi/research-analysis/high-interest-rates-euro-area-economy-impact.html

6 Bloomberg as of December 31, 2023

7 Reuters, November 21, 2023 https://www.reuters.com/markets/asia/boj-end-negative-interest-rates-2024-over-80-economists-say-2023-11-22/

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

Policies are issued by The Empire Life Insurance Company. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. is the Portfolio Manager of certain Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

March 2024