The world seems to revolve around credit cards and getting loyalty points. Loyalty points may be great if you pay off your balance each month. If you don’t, then the carrying cost on your credit card balance can quickly exceed any benefit from the loyalty program. You may get 1-3 points for every dollar you charge on your credit card. That’s 1-3%. You may get charged 19.99% on credit card balances. Work out how long it will take before those loyalty points get really expensive. The problem is that consumer desires are winning against investment discipline.

Now consider the debt itself. What’s better: investing your money and slowly paying down your debt or getting rid of that debt?

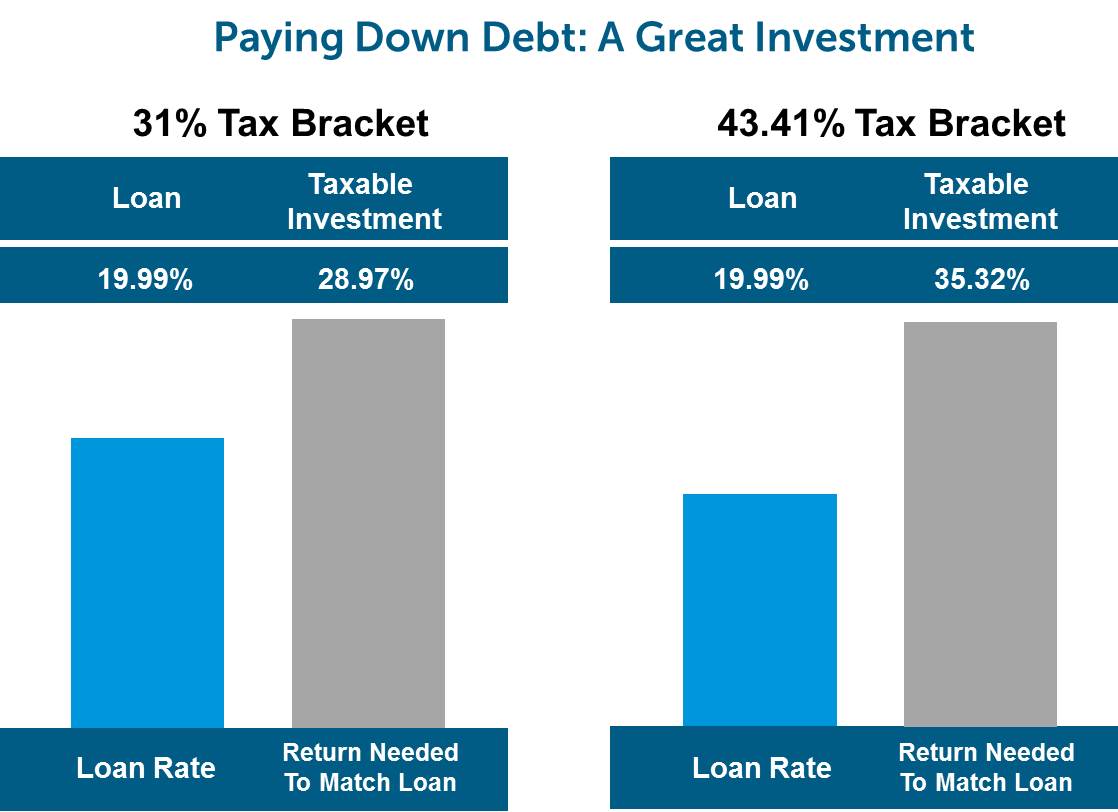

You may think that investing your money or keeping it invested is better than paying off that credit card. Think of this another way. Every dollar you owe in credit card balances and car loans is a dollar you are not investing. It’s a dollar your credit card company is making on you. Consider the following charts.

Let’s say you are in a 31% average tax bracket. If you are paying 19.99% in non-deductible loan interest, you will need to earn 28.97% from a fully taxable mutual fund or exchange traded fund invested in a bond portfolio just to match the return from paying down that credit card balance. If you are in a 43.41% tax bracket, your fully taxable investment would have to earn 35.32%.Where are you going to get that kind of guaranteed rate of return on a bond portfolio; or any portfolio? The rate of return you would need to earn on your investment portfolio to match the loan rate on “low interest” credit card charging 9.9% is still very high in today’s investment market. Even if your investment was heavily weighted in equities or sitting in a Tax Free Savings Account, you would have to earn an unreasonably high, steady rate of return for your financial strategy to work. And you would need to have high risk tolerance when choosing investments.

Pay off non-deductible debt as quickly and as soon as possible. It’s actually a great investment in your financial future. You’ll pay for your loyalty points once, truly get a benefit and have money that’s working for you instead of your creditors.