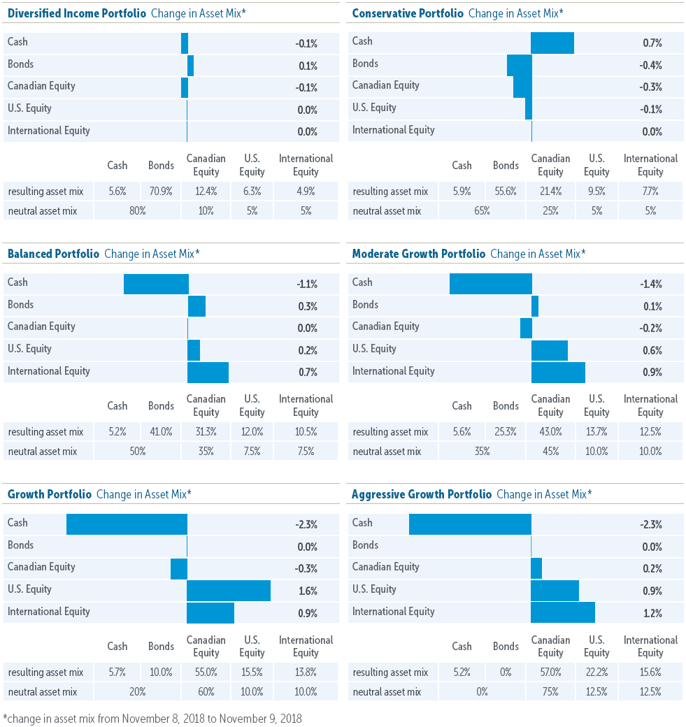

Key takeaways: Tactically increased U.S. and international equities, reduced cash. Remain overweight in equities and underweight in fixed income.

The month of October historically has been one of the most volatile months for the stock market, and this year has turned out to be no different.

The benchmark equity indices for the Canadian, U.S., and international markets all registered total return losses ranging from 5.5% to 6.5% (in Canadian dollar terms).

Not surprisingly, questions abound on whether this is just a normal correction or the start of the next major bear market. While one can never be entirely sure, we lean to the former. In our view, the strong macroeconomic environment and consistent growth in corporate earnings outweigh the risks posed by rising interest rates and trade tensions.

The results of the U.S. midterm elections are unlikely to lead to big policy changes, thereby eliminating a potential source of risk. Additionally, valuations have retraced back to more acceptable levels after the recent bout of volatility. In this light, we capitalized on the opportunity to deploy excess cash that had been accumulating over the past few months within the equity oriented Emblem portfolios1.

Proceeds were deployed into our U.S. and international equity model portfolios, based on the attractiveness of the underlying stocks in the current environment. Our U.S. equity model portfolio is built on a foundation of businesses that exhibit strong cash flow characteristics, while our international equity model portfolio is primarily invested in high quality companies and with an overall defensive bias.

(data source: Morningstar Direct)

1Includes Emblem Balanced, Emblem Moderate Growth, Emblem Growth, Emblem Aggressive Growth

Empire Life Investments Inc. is the Portfolio Manager of the Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Empire Life Emblem GIF Portfolios currently invest primarily in units of Empire Life Mutual Funds.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value.

Policies are issued by The Empire Life Insurance Company.

Empire Life Investments Inc. is the Manager of the Empire Life Emblem Portfolios and Empire Life Mutual Funds (the “Portfolios” or “Funds”). The units of the Portfolios and Funds are available only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such units.

This document includes forward-looking information that is based on the opinions and views of Empire Life Investments Inc. as of the date stated and is subject to change without notice. This information should not be considered a recommendation to buy or sell nor should they be relied upon as investment, tax or legal advice. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.