For many Canadians in their 50’s or older, their term life insurance policies may have come to an end. Would you know what to do next? As you get older, it’s important to re-evaluate your life insurance needs. How many years do you want to earn income before you retire? Or if you die, do you want to leave a financial cushion for your spouse, or contribute to your children or grandchildren’s education?

Life insurance can help you achieve your retirement goals after you stop working, and help protect your family after your death. The third and final part of The Stages of Life Insurance series highlights some facts and figures for those preparing their retirement and estate plans.

Check out our other infographics in The Stages of Life Insurance series:

Part 1: For the Young and Healthy

Part 2: For Committed and Growing Commitments

*Some life insurance advisors are also accredited estate planners.

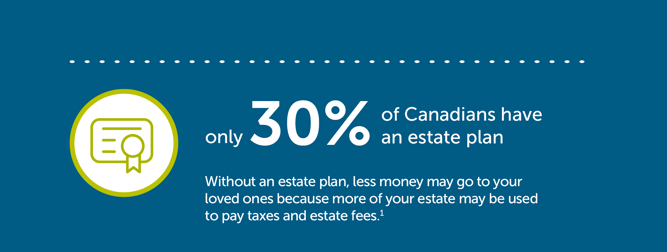

1 Ipsos Reid financial poll, 2014

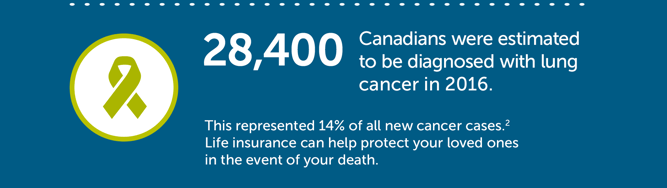

2 Canadian Cancer Statistics 2016. Canadian Cancer Society.

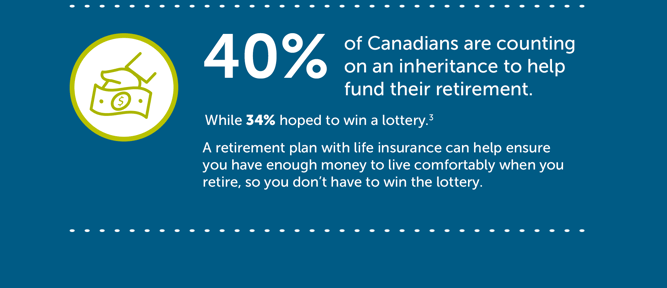

3 CBC News. Lottery win is retirement plan for 34% of poll respondents. 2014.