Young or old, planning for the future with life insurance is too often forgotten or placed on the back burner. You should think about life insurance when you have financial obligations, responsibilities and priorities. Could your family cover the mortgage payments and household maintenance costs if you died too soon? Would there be enough money for your children’s daycare, tuition for college or university?

Who is going to look after your loved ones when you are not around? This second of our three part The Stages of Life Insurance series shines a light on some factors to consider if you are newly married, a first time homeowner, or starting a family.

Check out our other infographics in The Stages of Life Insurance series:

Part 1: For the Young and Healthy

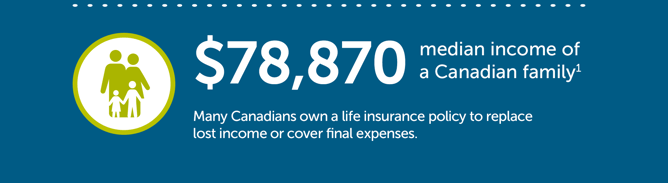

1 Statistics Canada 2014, CANSIM, table 111-0009.

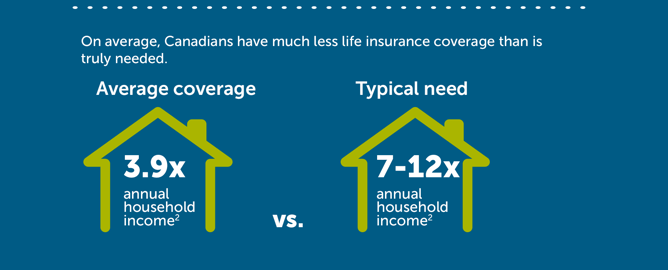

2 LIMRA 2014 Canadian Billion Dollar Baby Revisited.

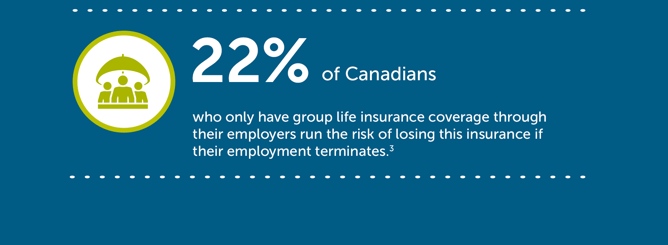

3 Canadian Life and Health Insurance Facts (2016 Edition).