In our last post in December, we talked about the idea of using insurance to protect the things you care about and value the most. Your good health just might be the most important thing you possess, and as we’ve seen during the pandemic, a public health emergency can turn the world on its head in an instant. The same holds true for families and individuals when a health crisis hits. This month we want to focus on the need to protect against the financial impacts of a serious health issue, and that’s where critical illness insurance comes in.

What is critical illness insurance?

Critical illness insurance is a relatively new type of coverage compared to life or disability insurance, but as with those types of coverage, you typically pay a premium for a set period of time and, should you be diagnosed with one of the covered illnesses or conditions and survive for a set period, you are eligible to receive the insurance benefit as a tax-free, lump sum payment.

The number of covered illnesses can vary from product to product, and from company to company, but most plans cover many forms of cancer, heart attack and stroke. As with life insurance, most buyers work with a licensed advisor to find the benefit amount and payment terms that work best for them. Unlike with life insurance, most critical illness insurance plans offer some type of return of premium option if you stay healthy and don’t require the insurance benefit through the end of the policy term.

Why do people buy critical illness insurance?

Of course people who buy insurance have their own, unique reasons for doing so, but there are some common threads according to an industry study.[i] Here are a few of the most common when it comes to critical illness insurance:

- Family history of serious illness

- Need to support spouse or other dependent

- Need income replacement but not eligible for disability insurance

- Want freedom to go outside public healthcare system if possible

Though these factors are different, most share the same underlying anxiety of potential financial impacts of dealing with a serious illness or condition.

Canadians tend to think of personal bankruptcies due to unexpected medical emergencies as something that happens primarily to people in the United States. They believe that Canada’s public healthcare systems will shelter them from those kinds of financial catastrophes. However, a study by researchers at the Harvard Medical School and the University of British Columbia suggests that this may be a false sense of security.

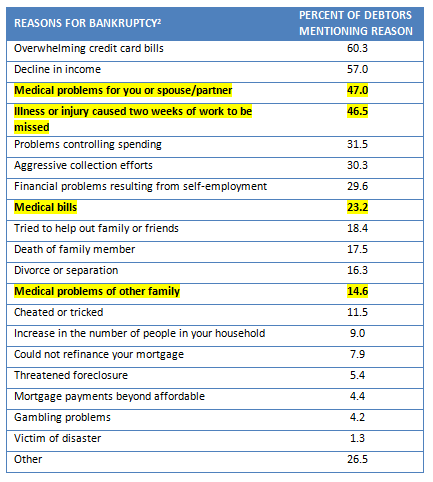

The study surveyed over 500 individuals in Canada who had gone through a bankruptcy filing during the preceding two years. The researchers found that over 45% reported losing at least two weeks of work-related income because of illness or injury in the two years had contributed significantly to their bankruptcy filing.[ii] As you can see in the table from the study, medical-related financial issues reportedly play a large role in Canadian bankruptcy filings:

Who needs critical illness insurance?

While Canadians may not receive the shock hospital bills that many Americans have to deal with as result of a surgery and other in-patient treatments and care, people diagnosed with a critical illness in Canada may need to pay out of pocket for expensive prescription drugs and/or the unexpected costs associated with seeking treatment outside of their province or in another country.

Even if the best course of treatment is available close to home, there are many new expenses to consider that are not covered by the public system or the group healthcare coverage offered by employers. Just some of those additional costs include:

- Transportation and parking: the cost of getting to and from hospital and other appointments if one is unable to drive is often far most expensive than people anticipate.

- Help around the home: those being treated for and recovering from a serious illness often find they need assistance caring for their homes and families.

- Food and meals: there are a lot of options these days for meal kits, pre-cooked and home delivery. One thing they all have in common is that they are not cheap.

- Time: most costly of all, potentially, is the lost time that could otherwise be used to earn a living.

Ask yourself this: “What’s my financial plan if I am unable to work for a month, six months or even a year?” If you don’t have an answer then you may be someone who could benefit from critical illness insurance.

It has probably happened to someone you know

According to the Canadian Cancer Society, nearly one out of every two people in Canada will be diagnosed with cancer at some point in their lifetime[iii]. That’s a simple and staggering statistic, and one that has not changed much over the last decade. What has changed for several of the most common types of cancer is that survival rates have improved significantly.

From 2012 to 2014, the most recent data currently available, 63% of Canadians diagnosed with cancer were expected to survive for 5 years or more after diagnosis. The survival rate was 55% only 20 years earlier. For breast cancer the stats are even more encouraging. The 5 year survival rate for this common type of the disease has nearly doubled since its high point in 1986 to 88% in 2020.[iv]

While it is great news that those diagnosed with a serious illness like breast cancer are more likely to survive for longer, the impact on their finances could be devastating and have long-lasting implications.

If you think critical illness insurance may be right for you, talk to an insurance advisor to find out if you qualify and to help you find a plan that works for your unique circumstances. To find out more about Critical Illness Insurance from Empire Life, please check out our website.

Notes:

[i] LIMRA, « Canada - Filling the Gap », MarketFacts Quarterly, 2002.

[ii] « Health Issues and Health Care Expenses in Canadian Bankruptcies and Insolvencies », International Journal of Health Services, vol. 44, no 1, 2014, p. 7-23.

[iii] “Cancer Statistics at a Glance,” Canadian Cancer Society: www.cancer.ca/en/cancer-information/cancer-101/cancer-statistics-at-a-glance/

[iv] « Cancer In Canada In 2020 », Canadian Medical Association Journal, 2020.

The information in this document is for general information purposes only. Please seek professional advice before making any decision.

This blog reflects the views of the author as of the date stated. This information should not be considered a recommendation to buy or sell nor should it be relied upon as investment, tax or legal advice. Empire Life and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

January 2021