Are you looking to purchase life insurance for the very first time and have no idea where to start?

Life insurance can be an overwhelming topic to think about and the amount of information available when looking to buy life insurance for the first time can be a bit daunting. The good news is that you have realized that purchasing life insurance is a great way to help protect your loved ones financially should anything happen to you. Now, what do you need to think about when making the purchase?

Life insurance can be an overwhelming topic to think about and the amount of information available when looking to buy life insurance for the first time can be a bit daunting. The good news is that you have realized that purchasing life insurance is a great way to help protect your loved ones financially should anything happen to you. Now, what do you need to think about when making the purchase?

Here are six tips to help you get organized, and help make the process of buying life insurance for the first time easier.

1) Understand Your Needs

Many people start looking for their first life insurance policy when an important event takes place in their lives; like getting married, buying a house, or having a baby. Others may simply be looking to prepare for a more secure future and to prepare for the unexpected. Whatever the reason may be, it is important to understand your insurance needs and what your goals are. The need for life insurance varies depending on your personal situation.

Remember though, if you don’t have any immediate needs for life insurance, you may still want to consider purchasing a smaller policy, if you anticipate you will have a need in the future. The primary reason: the younger you are the less expensive life insurance can be.

Remember though, if you don’t have any immediate needs for life insurance, you may still want to consider purchasing a smaller policy, if you anticipate you will have a need in the future. The primary reason: the younger you are the less expensive life insurance can be.

2) Determine How Much You Need

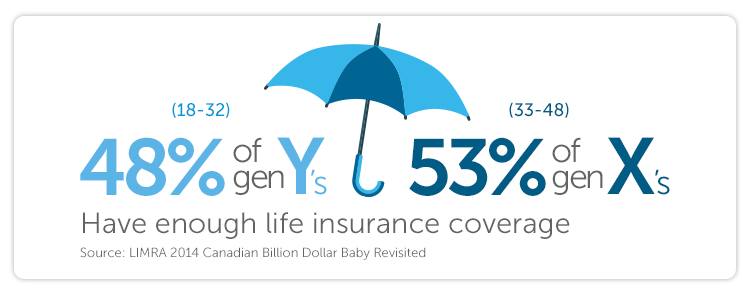

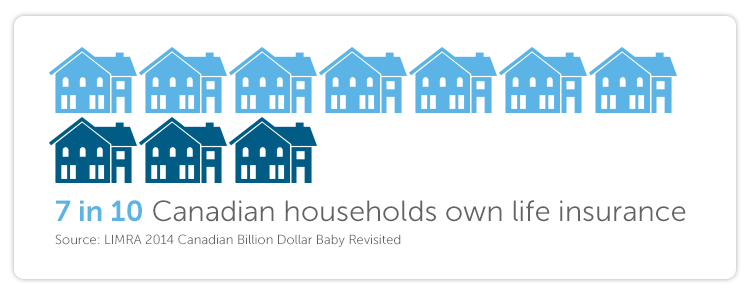

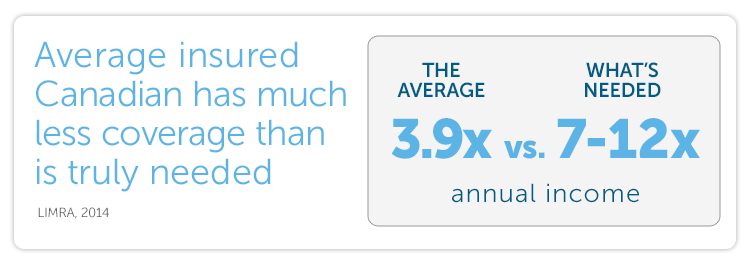

After you establish your insurance needs, it is important to determine the amount of coverage you need. Understanding your potential needs helps you decide how much insurance you should have.

Start by gathering all of your personal financial information and estimating what each of your family members would need to meet current and future financial obligations. This would include items such as funeral expenses, mortgage payments, car loans, credit card debt, education expenses, and replacement of your income.

Online needs analysis worksheets can help you put together this information and provide you with a quote.

3) Learn the Insurance Lingo

Life insurance can be confusing, with terms like "premium", "dividend", "beneficiary”, “riders”, and many more. Take some time to brush up on your insurance terminology. Becoming familiar with these terms can help you understand your policy, and help make the life insurance purchase process much simpler. We've put together a glossary of these terms to help you.

4) Find the Right Policy for Your Needs

Once you have crunched some numbers and learned some new insurance lingo, you need to understand the life insurance options that are available, and which type of policy will meet your needs.

There are two basic categories of life insurance: term insurance or permanent insurance.

Term insurance lasts for a set period of time (or “term”) and can be a very affordable choice. Permanent insurance is designed to last your lifetime as long as you pay your premiums, and is typically more expensive.

You can learn more about the different types of life insurance here.

5) Consider the Insurance Company

The company you choose to do business with can also be very important. You want to be sure to work with a company that has a solid history of financial health and receives high ratings from the rating agencies, has a high claim fulfillment rate and processes claims quickly.

Do your research so that you can be confident that you are putting your trust in the right life insurance company for you and your family members.

6) Connect with a Life Insurance Advisor

A life insurance advisor can help you understand the variety of products available and which ones might best balance your income protection needs with your monthly budget. He or she can customize an insurance plan that is right for you and your family.

To find an advisor near you who can answer any questions, to chat with one of our representatives, or to get a quote online, visit here.

Purchasing life insurance doesn't have to be difficult. It just requires you to ask some important questions, and take some time to think about your answers. Help is always available along the way, and once the purchasing process is complete, you can rest a little easier knowing you have prepared for the future and helped your loved ones be financially secure.