Markets go up and markets go down. That’s the nature of investing in stocks and bonds, whether directly or indirectly through investment funds. Investors generally like upside volatility (when markets go up), but are much less tolerable towards downside volatility (when markets go down). Implementing downside protection strategies regardless of current market conditions can help reduce volatility when markets do go down, thereby helping to preserve and build wealth over the long-term.

Asymmetry of gains and losses

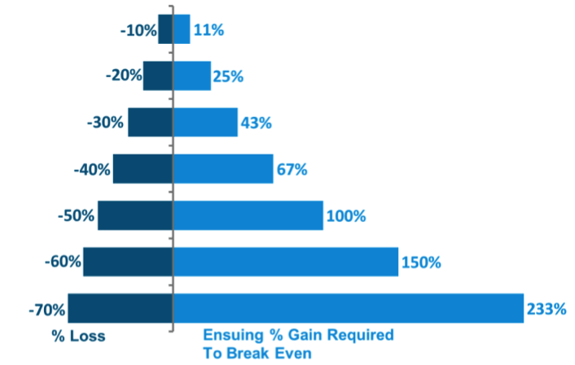

The asymmetrical nature of gains and losses is one reason why implementing downside protection is important. If an investment declines 30% from its peak, it would require a 43% gain in the ensuing period just to break even. Take for example a $10 stock. If it falls 30%, its value is now $7. That $7 stock would need to gain $3 to return back to the original $10, which is a 43% gain.

The larger the loss, the more amplified this asymmetrical nature becomes as the following chart illustrates. A 60% loss would require a 150% gain to break even. Therefore, the more effectively an investor can limit losses during down markets using downside protection strategies, the better shape they will be in to recover and build wealth over the long term.

For Illustrative Purposes Only

Investor Behaviour

Human nature (investor behavior specifically) is another reason why downside protection is important. Despite continued education on the importance of staying invested, investors continue the bad habit of trying to time the markets and often end up buying and selling at the wrong time.

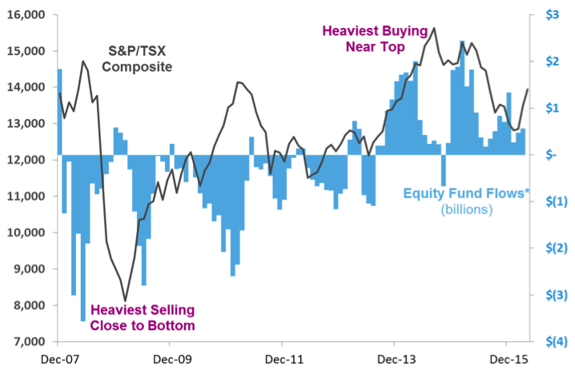

The following chart compares the estimated equity fund flows of Canadian investors (blue bars) and the S&P/TSX Composite (grey line) from 2007 to 2015. It highlights that during one of the strongest bull markets in Canadian history – from March 2009 to August 2013 – investors were primarily selling their equity mutual fund and ETF holdings, therefore missing out on market growth. Equity fund flows generally turned positive after that, with the heaviest inflows occurring just before and after the market peaked in August 2014, resulting in investors buying when prices were high.

* Average 3 month estimated equity ETF and mutual fund flows among Canadian investors

Source: Morningstar Direct, Bloomberg (December 2007-April 2016)

Dalbar’s annual report of U.S. investor returns1 quantifies the results of these bad timing decisions. Over a 30 year period (to the end of 2014), the average U.S. equity fund investor gained about 3.8% annualized, while the S&P 500 gained 11.1%, representing a dramatic disparity between investor and market returns.

1 Source: Dalbar April 21, 2015 press release regarding annual Quantitative Analysis of Investor Behaviour report

(click here for full press release)

Implementing downside protection strategies regardless of market conditions may help prevent investors from over-reacting to market volatility and incorrectly timing the markets. In part 2 of this series, I will focus on the various downside protection strategies investors can implement.