My last blog discussed the importance of downside protection, specifically looking at the asymmetry of gains and losses, and poor historical investor behaviour. This blog will investigate some strategies investors can implement to potentially protect their portfolio from significant losses in down markets, while still allowing them to participate in rising markets.

Diversification

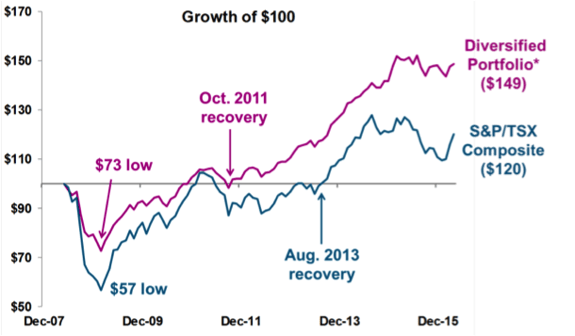

The first downside protection strategy to consider is also the first rule of investing - diversification. The growth of $100 chart illustrates the power of diversification. The blue line represents S&P/TSX Composite Index, which is designated as the non-diversified investment. The purple line represents a diversified portfolio comprised equally of the S&P/TSX Composite, FTSE TMX Canada Bond Universe, and MSCI World; in other words, one third each of Canadian equities, Canadian bonds, and global equities.

Source: Morningstar Direct May 2008-December 2015

The chart intentionally starts in May 2008, at the peak of the market before the financial crisis to show real world downside performance. The first item to note is how the diversified portfolio declined much less during the crisis, from $100 to $73, while the non-diversified portfolio declined to $57. Second, the diversified portfolio recovered and sustainably grew above the $100 initial investment in October 2011, more quickly than the non-diversified portfolio. It took the non-diversified portfolio an additional 22 months (to August 2013) to achieve a sustained recovery. Finally, because of its broad based geographical exposure, the diversified portfolio was better able to navigate the market volatility in 2015, leading to a dramatic widening of relative growth. As of April 2016, the diversified portfolio grew to $149, compared to $120 for the TSX Composite Index.

Value-oriented investing

Another strategy to help investors protect their portfolio in down markets is to adopt a value style of investing. Value investing focuses on companies, whose stock price is trading below the long-term intrinsic value. The difference between the intrinsic value and stock price is the margin of safety – the larger the margin of safety, the greater the downside protection as shown in the following illustration.

For illustrative purposes only.

A stock with a larger margin of safety has a larger degree of risk already reflected in its price. Therefore when markets go down, these stocks should decline less. A stock trading above its intrinsic value has a degree of speculation reflected in its price and this speculation may quickly deflate when market sentiment turns negative.

Dollar Cost Averaging

Dollar cost averaging - investing on a regular basis - can help mitigate the effects of a market correction and the asymmetrical gains required to recover from that market correction.

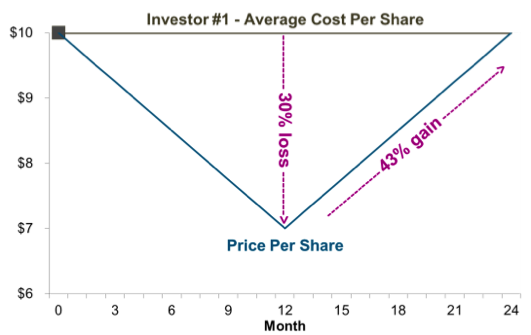

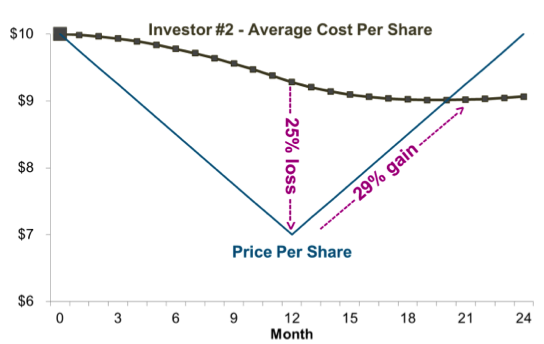

The following scenario examines two investors purchasing $1,000 each in stock XYZ. Investor #1 invests the initial $1,000 lump sum, but Investor #2 also invests an additional $50 each month. Stock XYZ falls from $10 to $7 over the first 12 months, and then rallies back to $10 over the following 12 months.

Investor #1 is subject to the same asymmetrical loss/gain dynamic discussed in my blog on the importance of downside protection, where a 30% loss requires an ensuing 43% gain to recoup the losses.

For illustrative purposes only.

Investor #2’s loss/gain profile is significantly improved. Its 25% loss after 12 months only requires a 29% ensuing gain to break-even. The break-even point occurs 4 months before that of investor #1, and is in profit territory thereafter. The key to this improvement is continuing to buy shares at lower prices to drive down the average cost per share. The lower the average cost, the sooner the investor will break-even and be positioned to build wealth.

For illustrative purposes only.

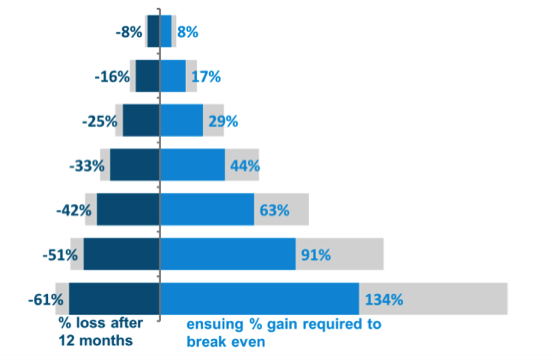

Reducing the portfolio’s average cost per share through dollar-cost averaging can reduce the undesirable asymmetrical loss/gain dynamic as shown in the following graphic. The grey bars represent the loss/gain dynamic without dollar cost averaging, while the blue bars reflect the loss/gain dynamic using a monthly dollar-cost averaging strategy of 5% of the original investment.

The greater the loss incurred, the greater the power of dollar-cost averaging in producing a much more balanced dynamic.

For illustrative purposes only.

It is important to note that the strategies discussed here are not mutually exclusive. Investors can combine them to potentially achieve an enhanced level of downside protection.

Stay tuned for the next blog in this series, where we will look at the statistical measures that can be used to evaluate downside protection.